[Application layer] Why vertical SaaS in an era of GenAI?

For startup founders, why there's a higher chance of success for vertical GenAI products?

Estimated reading time: 6 minutes

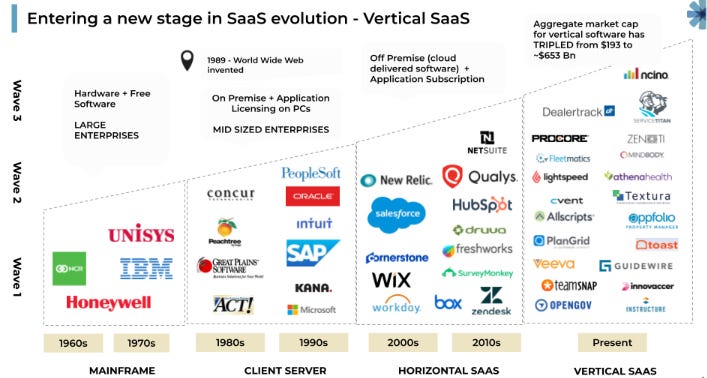

Vertical SaaS has become increasingly popular over the last 5 years. In contrast to horizontal SaaS that serves everyone, vertical SaaS specializes in one niche that tailors offerings to customers within that space. For example, vertical solutions initially gained traction in healthcare and financial services. These products are designed to meet highly specialized needs, including customized client interactions, unique data processing formats, and secure storage of sensitive information.

In the era of GenAI, why do I believe vertical SaaS leads a path to success? I am not suggesting horizontal GenAI solutions lack a future - for startup founders, the amount of investment and effort in developing a horizontal product is indeed way more than what you need for a vertical product, unfortunately, with a higher risk the same time. Here’s my reasoning.

All discussion below is focused on GenAI application layer solutions. Opinions are my own.

People don’t need good-enough GenAI products

The core value of GenAI apps is to assist humans do a better job, or free up human labor with the help of virtual agents. Companies are no longer looking for some sketchy or good-enough solutions. Instead, they require tools that relieve employee workload without introducing additional complexities. Companies need high performance tools that they can trust and rely on, which means better-than-human level model accuracy and precision. Consider insurance companies that require a productivity tool capable of collecting, organizing, and summarizing claims. Underwriters rely on this tool to assess total claim amounts by analyzing documents. Any inaccuracy could lead to litigation and financial losses. Another example, consider a GenAI agent assisting lawyers by pre-processing documents. Even minor misinformation could result in unintended consequences in legal proceedings.

Not to mention, different companies have different workflows and use different domains of data. It is rather difficult to create a model that fits everyone. Even giant model like GPT4 can’t fulfill all the needs. Startups are not likely to access the same amount of computing resources, capital and engineers; the fact that you aim for a horizontal solution means you need industry specific data from all verticals to make your model differentiated from the state-of-art-one trained on the public dataset.

Verticalization allows you do develop a high-performing product, even with limited resources

However, a vertical focus narrows your scope to specific domains, resulting in a more manageable data requirement (though still substantial). If you have accumulated industry experience, you probably have good insights into critical data types for your startup idea, effective collection methods, and the characteristics of quality datasets.

Having access to proprietary data allows you to achieve above-industry-average performance without requiring extensive computing resources (again, relatively speaking). Empirical evidence demonstrates that small-sized LLMs (such as 3B and 7B models) fine-tuned on domain specific data can even outperform the larger one (such as GPT4) (example from the paper). Additionally, the availability of open source LLMs also eliminates the cost of pre-training and reduces the cost of fine tuning.

Your moat is not just the fine-tuned model

Fine tuning the smaller LLM is only the first step. Your moat partially comes from the model, but you are almost replaceable if another company somehow gets the same data and fine tunes a similar model. Large tech companies often find ways to acquire necessary data—it’s just a matter of time.

The true moat lies in the ecosystem that you cultivate over time. While the LLM product serves as an entry point, it’s crucial to continually delve into industry workflows and pain points. By doing so, you can develop features and modules that complement your core solutions. Rather than relying on broad horizontal approaches, your suite should offer enhanced capabilities across the board. For instance, consider a supply chain risk management company: Begin by assessing companies’ risk profiles using GenAI, then leverage your business network to collect additional company data, enhancing the accuracy of risk assessment algorithms. Finally, create a network where suppliers can connect with potential clients and business partners.

Who is your biggest threat?

What is the biggest fear for a GenAI startup founder?

OpenAI DevDay.

In my view, the biggest potential competitors for a startup company are (1) OpenAI, and (2) horizontal tech giants such as FAANG. Why?

While OpenAI has focused on improving foundation model performance, the launch of GPT Store has killed numerous startup ideas; Pika, once considered the leader of video generation, soon got overtaken by Sora. The impact of rumors around GPT Search on the future of Perplexity AI is widely discussed, yet outcome remains uncertain.

Our second group - large horizontal providers - is never late to the game. Microsoft’s partnership with OpenAI, Google’s foundational research in transformer models, and Meta’s substantial GPU investments all demonstrate their proactive approach to enhancing services with GenAI. These companies seek to create upsell and cross-sell opportunities within their existing user base while maintaining customer satisfaction.

Your winning strategy should never be betting that OpenAI and major tech players will overlook low hanging fruits. Why would they? If Microsoft has such a strong user base in office productivity tools, why would they not look into GenAI capability to further enhance user experience? Similarly, if Search is such a common use case of GPT, why OpenAI would miss it on their roadmap?

One could argue that large tech companies often move more slowly than startups, granting startups a first-mover advantage. This is true. However, keep in mind that once these companies launch their products - potentially outperforming yours - you’ll likely face customer churn.

So, your winning strategy is…

You should not wait for competitors to NOT react; instead, identify a niche that substantially raises their cost of entry or diverges from their overall product strategy and roadmap.

From a logical standpoint, horizontal players tend to prioritize horizontal GenAI solutions, as these align most closely with their existing customer base and create significant revenue synergy. Before integrating GenAI capabilities to their existing solutions, large companies are unlikely to explore vertical-specific products extensively. After all, these verticals may constitute only 10-20% of their current customer base.

So verticalization is the answer. Your vertical solution can enter the market well ahead of an equivalent horizontal offering. Beyond timing, your solution is likely better suited to the vertical, making it more appealing to end users. Your established presence within the vertical enables you to gather additional industry domain data, which can then be used to fine-tune your model and create a network effect. This positive cycle perpetuates itself. Even when larger horizontal vendors eventually enter this vertical, acquiring your highly satisfied customers will prove exceptionally challenging.

Of course, there are always caveats

The primary challenge in running a vertical startup lies in the need for deep industry knowledge - understanding pain points, customer needs, and the ability to tailor solutions. Indeed, this customization is the core value proposition of a vertical solution. Without industry expertise, let’s say, you are a fresh undergrad, it is literally impossible to guess what your future customers need. This is the first barrier of launching a successful vertical startup.

The second, more apparent drawback is the smaller total addressable market (TAM). By targeting one or two verticals, the total size of pie is limited, compared to horizontal solutions where you can claim every business could be your potential customer. I would argue, though, the actual TAM for a horizontal GenAI vendor should be smaller than claimed. Why? For the reason we raised in the beginning - today’s customers no longer settle for generic solutions. They swiftly pivot to alternatives that genuinely enhance business efficiency and productivity. In this context, a well-tailored vertical solution can often outperform its broader counterparts.